In the realm of global finance, achieving faster, cheaper, and more transparent cross-border payments has been a longstanding goal. The introduction of the Legal Entity Identifier (LEI) and the efforts of the Global Legal Entity Identifier Foundation (GLEIF) are bringing this vision closer to reality. The LEI, a unique identifier assigned to legal entities involved in financial transactions, holds the potential to transform the way money moves across borders.

Advancing Transparency and Efficiency

Integrating the LEI into cross-border payments offers enhanced transparency. By including the LEI in payment messages, financial institutions can instantly and accurately identify the entities involved in transactions. This streamlines processes, reduces the risk of fraud, and ensures compliance with regulations.

Endorsement by Financial Authorities

The endorsement of the LEI by influential bodies such as the Financial Stability Board (FSB) underscores its importance in improving cross-border payments. Aligned with the FSB’s roadmap, efforts are underway to standardise the use of the LEI in payment messaging, facilitating its integration into existing payment systems.

Key Use Cases and Collaborations

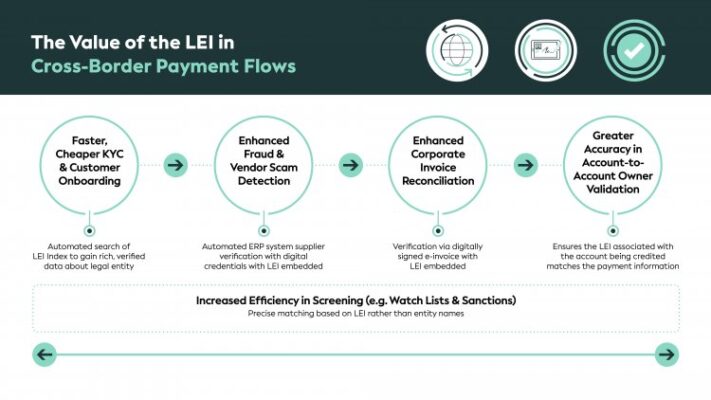

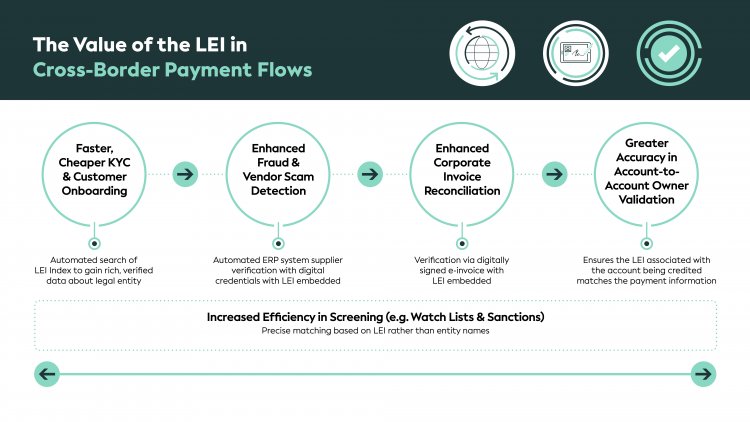

GLEIF, collaborating with industry stakeholders, has identified five key use cases demonstrating the value of the LEI in cross-border payments. These include screening, Know Your Customer (KYC), fraud detection, e-invoice reconciliation, and account validation. Collaborations with various organisations highlight the benefits, from faster KYC processes to improved fraud detection.

Building Trust and Transparency

The adoption of the LEI extends beyond financial institutions, with central banks recognising its potential to promote transparency. Initiatives such as the utilisation of the LEI by regulatory bodies highlight its role in fostering integrity within financial systems.

Toward a Smarter Financial Future

As finance evolves, integrating the LEI into cross-border payments represents a significant step forward. By enabling precise identification of entities involved in transactions, the LEI fosters transparency, reduces costs, and enhances compliance. With ongoing efforts to promote its use, the LEI is poised to shape the future of cross-border payments, driving innovation and trust in the global financial landscape.