The Value of Regulatory Screening for Financial Institutions

Regulatory screening plays a crucial role in ensuring the stability and integrity of the global financial system. It involves monitoring and assessing financial institutions’ compliance with regulations and standards set by regulatory bodies and sectorial standard setters. In an increasingly complex and interconnected financial landscape, regulatory screening has become even more critical to

mitigate compliance and risk management issues. This article explores the importance of regulatory screening for financial institutions in the banking, insurance, securities trading, and asset management sectors. It also examines the use of supervisory and regulatory technologies by sectorial authorities and regulated institutions.

Regulatory Screening and Its Relevance:

The financial services industry is one of the most heavily regulated business sectors, and the regulatory landscape has substantially become more complex since the global financial crisis of 2007/2008. According to a 2017 report from The Boston Consulting Group, banks must now track an average of 200 regulatory revisions per day on a global scale. New regulations significantly impact the business model of organizations and their ability to continue doing business with specific clients, products, and markets. The effective management of regulatory risk is crucial, yet many organizations struggle with a deficient allocation of process ownership, poor system support based on end-user applications, and a lack of proactive, forward-looking project management. Moreover, the financial industry is facing new challenges that add to the complexity of regulatory compliance. Cybersecurity threats, changes in technology, and the use of third-party service providers all present new risks and challenges for organizations in the financial industry. In this context, regulatory screening helps to maintain the soundness and stability of financial institutions by ensuring they adhere to industry regulations and standards. The value of regulatory screening extends beyond mere compliance adherence. Pertinent

regulatory screening assists financial institutions in identifying new changes in the regulatory ecosystem that will enable them to prevent financial fraud, money laundering, terrorist financing, and other illicit activities. The screening process involves scrutiny of publications by national authorities and international standard-setters to ensure that institutions timely and effectively implement processes strengthening their operations, risk management practices, and internal controls to identify any potential non-compliance or violations of the regulatory framework

By Regulators and Sectorial Standard Setters:

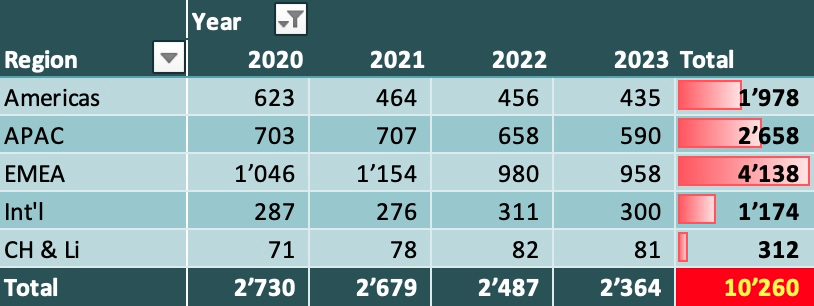

Regulatory bodies and sectorial standard setters publish numerous

guidelines, directives, and standards to guide financial institutions in their

compliance efforts. These publications provide a roadmap for institutions to

follow and highlight key areas of focus. For example, the “Weekly Regulatory

Digest” has identified over ten thousand publications originating from

regulators and sectorial standard setters over the past four years, as

illustrated in this table.

Use of Supervisory and Regulatory Technologies:

In recent years, advancements in technology have revolutionized regulatory screening processes. Both sectorial authorities and regulated institutions have embraced supervisory and regulatory technologies to enhance their compliance and risk management efforts. These technologies include automated risk assessment tools, machine learning algorithms, data analytics, and artificial intelligence.

By utilizing supervisory technologies, regulatory authorities can conduct more efficient and effective supervision of financial institutions. These technologies can analyze large volumes of data, identify patterns, detect anomalies, and generate real-time risk alerts. Regulated institutions, on the other hand, can deploy regulatory technologies to automate compliance processes, streamline

reporting, and enhance internal controls.

ROCHAT¦Advisory {Governance, Investigations, Audit}

Weekly Regulatory Digest Page 2 of 3

Focus Points for the Coming Years:

Looking ahead, regulatory authorities and sectorial standard setters have several key focus points to address in the coming years.

These include:

(i) Strengthening Cybersecurity: The increasing threat of cyber-attacks necessitates a higher emphasis on cybersecurity measures across the financial industry. Regulatory attention will focus on ensuring financial institutions have robust cybersecurity frameworks in place to protect customer data and prevent potential breaches.

(ii) Enhanced Risk Management Practices: Regulatory attention will emphasize the implementation of advanced risk management practices and operational resilience within financial institutions. This includes effective governance, risk identification, assessment, and mitigation strategies.

(iii) Climate Risk and ESG Factors: Addressing climate risk and considering Environmental, Social, and Governance (ESG) factors have gained significant importance in recent years. Regulatory attention will increasingly focus on these areas to ensure that financial institutions incorporate sustainability considerations into their decision-making processes.

Regulatory screening has become an indispensable component of financial operations, fostering compliance, risk management, and the overall integrity of the financial system. As financial institutions navigate the complexities of the global financial landscape, regulatory screening will continue to play a pivotal role in safeguarding their operations and upholding the trust of their stakeholders.

Regulatory Complexity and Cross-Border Business

Several regulatory bodies and standard setters have expressed concerns regarding the complexity and interconnectedness of regulatory requirements, particularly in the context of cross-border business operations. These concerns stem from the perception that the sheer volume and intricate nature of regulatory frameworks hinder the ability of financial institutions to effectively comply

and manage risks, thereby hampering their ability to operate seamlessly across borders.

Key Points Raised by Regulatory Bodies include:

(i) Regulatory Overlapping and Fragmentation: The overlapping and fragmented nature of regulatory frameworks across jurisdictions creates challenges for financial institutions in navigating and adhering to diverse requirements. This complexity demands specialized expertise and resources, potentially increasing operational costs and hindering efficiency.

(ii) Inconsistent Application of Regulations: Differences in regulatory interpretation and enforcement practices across jurisdictions can lead to inconsistencies in risk assessment and compliance approaches. This variability complicates the management of regulatory risks and may lead to operational inconsistencies.

(iii) Regulatory Arbitrage and Regulatory Capture: The complex regulatory landscape can incentivize regulatory arbitrage, where financial institutions seek to exploit loopholes or inconsistencies to minimize their compliance burden. This behavior can undermine the effectiveness of regulatory frameworks and create market distortions.

(iv) Impact on Cross-Border Business: The cumulative effect of regulatory complexity and fragmentation is to impede cross-border

business operations, making it more challenging for financial institutions to conduct transactions and establish operational

presence in multiple jurisdictions. This can hinder financial inclusion and limit the development of global financial markets.

Similarly, regulatory complexity significantly affects financial institutions:

§ Complexity

o Financial institutions often face confusion and uncertainty when interpreting complex regulatory requirements.

o The sheer number of regulations can be overwhelming, making it challenging for institutions to stay compliant across all

jurisdictions.

o Regulatory requirements are often interconnected, with changes in one area having ripple effects across other areas of the

financial system.

§ Interconnectedness

o Regulatory requirements can differ significantly from one country to another, creating barriers to cross-border business.

o The lack of harmonization between regulatory regimes can lead to regulatory arbitrage, where institutions seek to operate in

jurisdictions with lower regulatory standards.

o The interconnectedness of regulatory requirements can make it difficult for institutions to implement effective risk

management practices across their global operations.

§ Impact on Cross-Border Business

o The complexity and interconnectedness of regulatory requirements can increase the cost of doing business for financial

institutions, especially those operating across borders.

o These factors can discourage institutions from expanding into new markets or offering new products and services.

o The overall competitiveness of the global financial system can be hampered by these challenges.

ROCHAT¦Advisory {Governance, Investigations, Audit}

Weekly Regulatory Digest Page 3 of 3

Examples of Statements by International Standard Setters Include:

§ The Basel Committee on Banking Supervision (BCBS) has stated that “the complexity and interconnectedness of financial

regulation can hinder the effectiveness of regulation and increase the cost of compliance for institutions.” (BCBS, 2017)

§ The Financial Stability Board (FSB) has acknowledged that “the complexity of the global regulatory framework can impede the

ability of institutions to efficiently adapt to regulatory changes and effectively manage risks.” (FSB, 2015)

§ The International Monetary Fund (IMF) has observed that “the interconnectedness of regulatory requirements can create

challenges for institutions that operate across borders.” (IMF, 2015)

Financial institutions ensure compliance with regulations by following the laws, regulations, and guidelines set by regional, national,

and international bodies. Compliance risk has become one of the most significant ongoing concerns for financial institution executives.

The responsibility for ensuring an institution is complying with the regulatory framework appropriately rests with the Board of

Directors and the management of the institution.

Meilen, 10 January 2024 / JCR

ROCHAT¦Advisory

Rainstrasse 372, 8706 Meilen

Tel. +41 78 748 2459

j-cr@rochat-advisory.biz

www.rochat-advisory.biz

VAT: CHE-497.637.568 MwSt