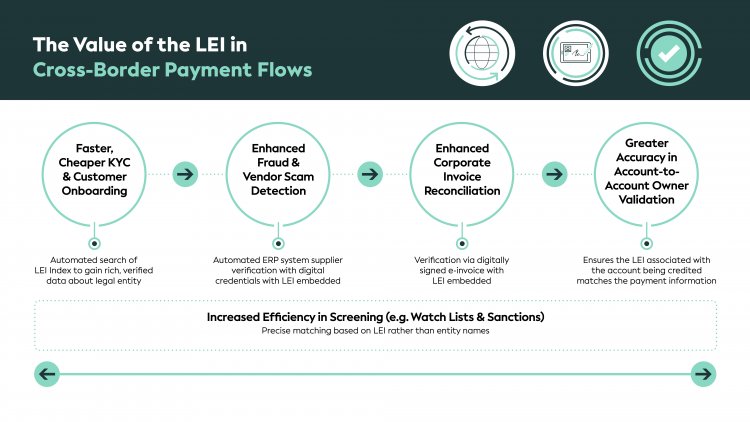

Since the LEI was introduced, there have been over 115 regulations that require certain organisations to obtain an LEI code across different jurisdictions and industries both municipally and commercially.

Having a Legal Entity Identifier, or LEI code is mandated by EU, US and many other african countries regulators in order to engage in financial markets activities e.g securities trading or derivatives.

LEIs are required by Limited Companies, funds & trusts, banks, lenders, OTC Derivatives and securities market participants, pension funds, Central banks & others FI, Trade Tech, Customs. Financial Market Authorities, Mining, Oils an Gas industry, Trade Finance, SMEs 6 Startups, Marketplace, Family Offices, NGOs , Fintech , Stock Markets

Crypto Asset Managers and any regulated industry.

There are a number of mandates currently in existence which state ``no LEI, no trade`` as the phrase was coined by ESMA (European Securities & Markets Authority). The LEI is heavily relied upon in EU market a number of directives such as EMIR , MiFIR & MIFID II.

However, the US also have similar requirements such as the Dodd Frank Act, the OFR, the Federal Reserve and the Securities & Exchange commission (SEC).

To see a list of laws in your country visit: https://www.gleif.org/en/lei-solutions/regulatory-use-of-the-lei

Types of organisations that require an LEI (not limited to):

Financial intermediaries (CSDs)

Banks, investment companies and lenders

Trade OTC derivatives (except private individuals)

SMSF (Self Managed Superannuation Funds) traders and trustees

Investment Vehicles, mutual funds, hedge funds

Pension schemes

Commodities trading

CFDs (Contract for Differences)

Securities transactions, SFTR reporting

Entities listed on a stock exchange

International Branch offices (The Head Office must already have an LEI)**